Disclaimer and Risk Warning: This content is for general information and educational purposes only, without representation or warranty. It should not be construed as financial, legal, or other professional advice, nor intended to recommend purchasing any specific product or service. You should seek advice from appropriate professional advisors.

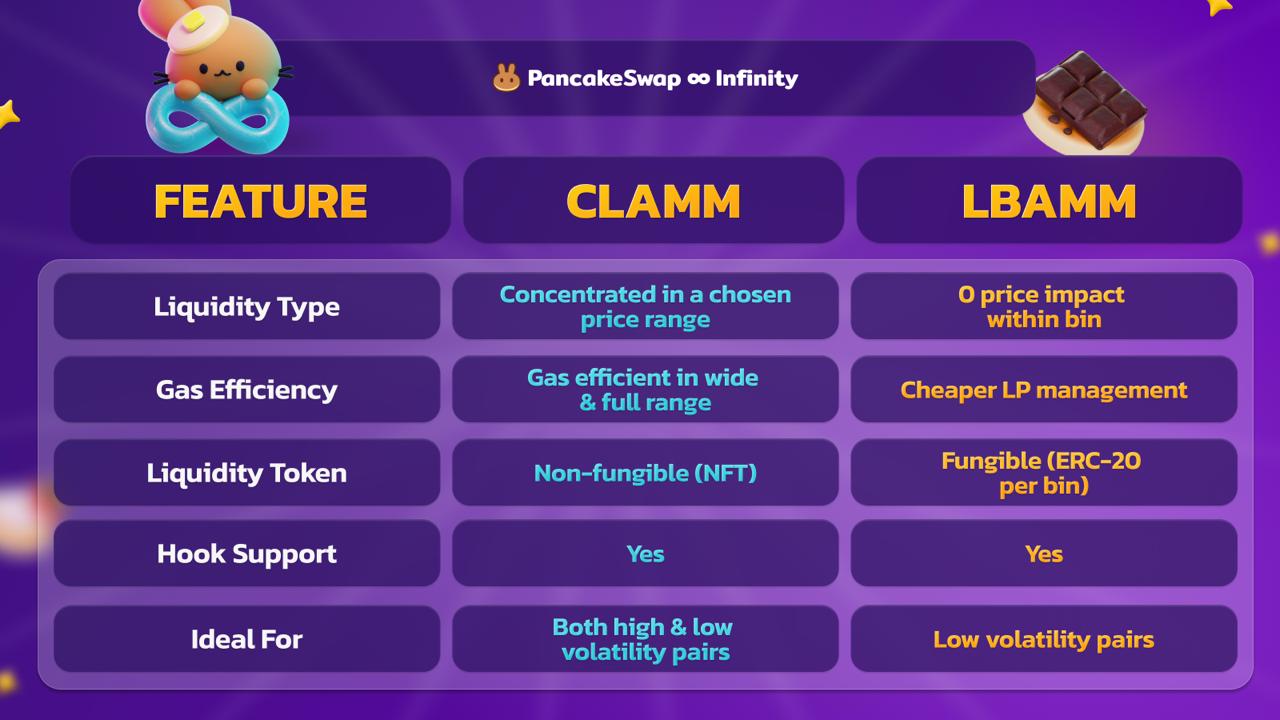

PancakeSwap Infinity provides liquidity providers (LPs) with greater flexibility to manage their liquidity. It supports two main pool types: CLAMM (Concentrated Liquidity AMM) and LBAMM (Liquidity Book AMM). Each pool type is designed to serve different market conditions, allowing LPs to select the one that best aligns with their goals and risk preferences.

This guide explores the key differences between CLAMM and LBAMM, their benefits, and which type might suit you best.

What Are Liquidity Pools?

Liquidity pools are essential to decentralized exchanges (DEXs). These pools allow liquidity providers to contribute their tokens, enabling other users to trade those tokens. In return, liquidity providers can earn a share of the trading fees paid by traders on platforms like PancakeSwap. While most DEXs offer a single type of liquidity pool, PancakeSwap Infinity goes a step further by supporting two types: CLAMM and LBAMM. Each of these pool types is designed to meet different trading needs, providing more flexibility and opportunities for liquidity providers.

CLAMM (Concentrated Liquidity AMM)

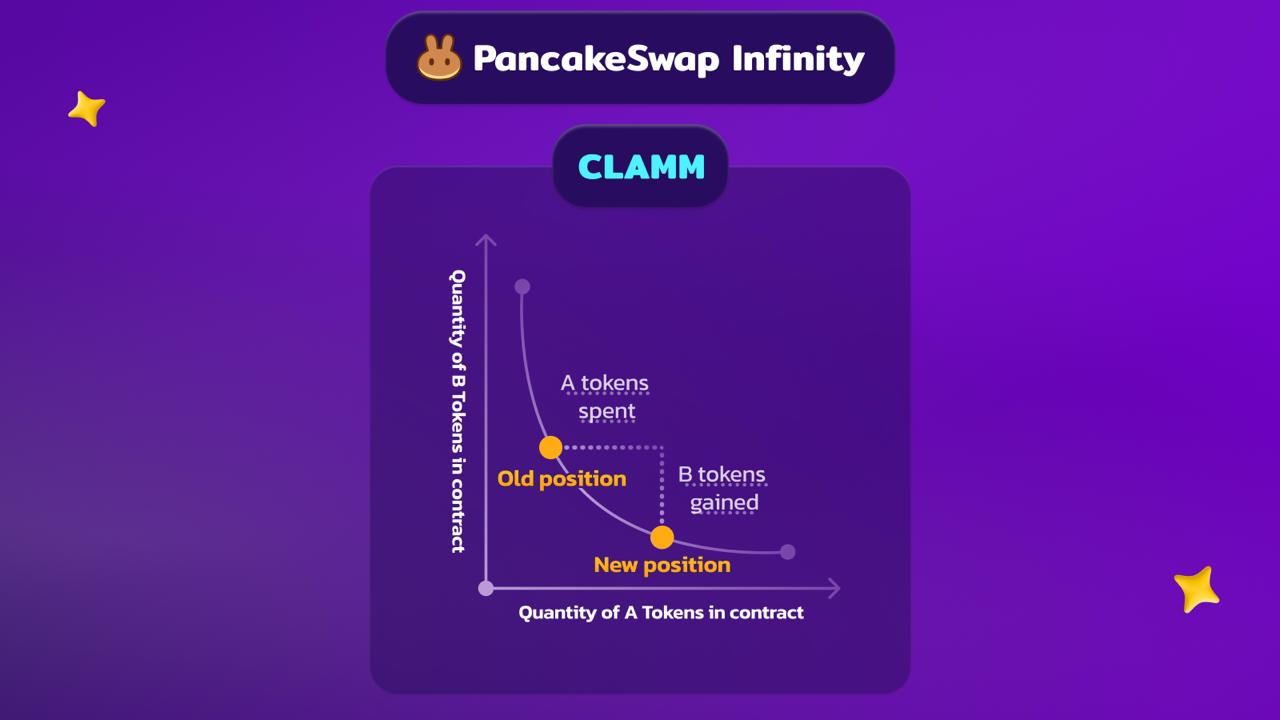

CLAMM enables LPs to concentrate their liquidity within a chosen price range rather than distributing it across the entire price spectrum. This results in better capital efficiency, as liquidity is focused where the most trading activity is expected. However, it also requires active management, as LPs need to adjust their positions if the market price moves outside their selected range.

A well-known example of CLAMM is PancakeSwap v3, which allows LPs to define specific price ranges for their liquidity, offering more efficient use of capital. If you're familiar with PancakeSwap v3, you'll recognize the mechanics of CLAMM. CLAMM allows you to concentrate liquidity in price zones where you expect most trading to occur. For a deeper dive into CLAMM and its features, you can refer to the PancakeSwap v3 documentation.

Key Features of CLAMM:

- Capital Efficiency: Liquidity is concentrated in high-activity price ranges, ensuring that tokens are actively used rather than spread thinly.

- Reduced Slippage: Traders experience less price slippage when making swaps within concentrated price zones.

- Customizable Price Ranges: LPs can adjust their price ranges based on market conditions.

Things to Keep in Mind:

- Active Management: Since liquidity is only active within the chosen price range, LPs need to monitor the market and adjust their positions if the price moves outside that range, which can temporarily cause their liquidity to become inactive.

Best For:

- Active LPs who monitor the market regularly and are comfortable adjusting their positions.

- Suitable for high and low-volatile pairs, offering a broad range of strategies.

LBAMM (Liquidity Book AMM)

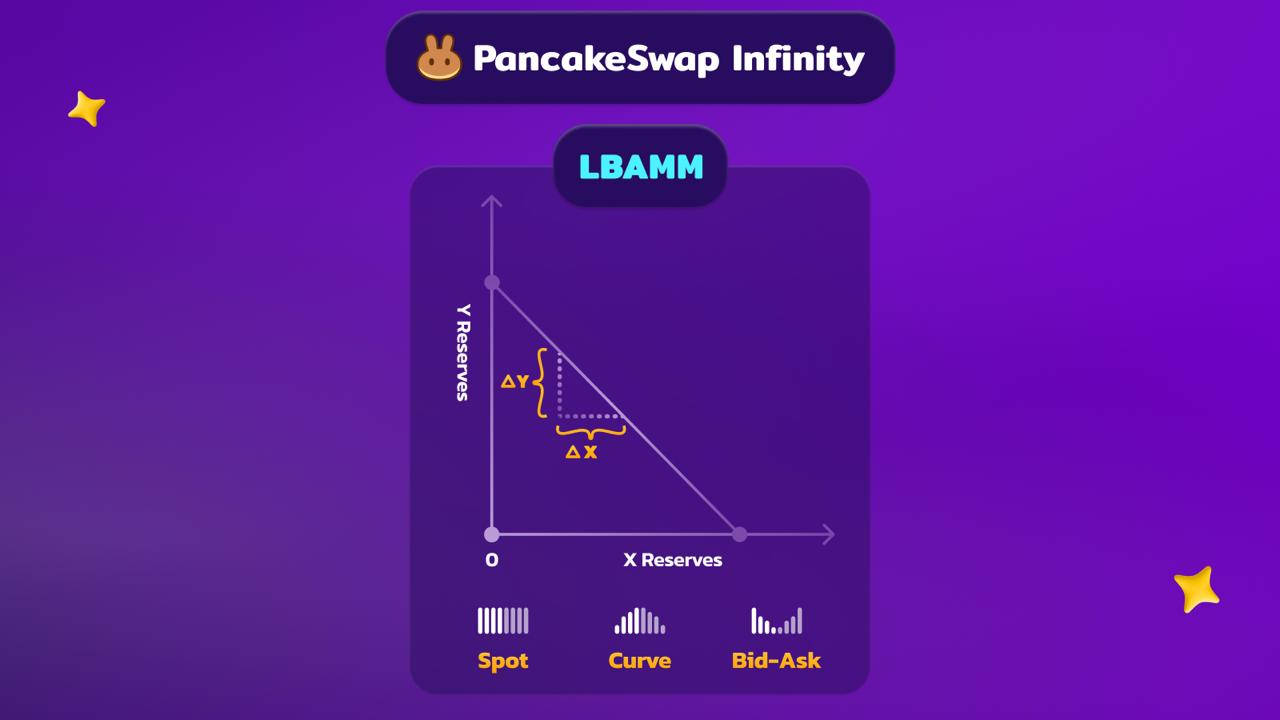

LBAMM, a newer model supported by PancakeSwap Infinity, organizes liquidity into "price bins" — specific price levels or intervals. Liquidity is distributed across these bins, and when trading happens within a single bin, there is zero price impact. This means trades within a bin don’t cause any price changes, providing a smooth experience for traders.

LBAMM is particularly well-suited for low-volatility token pairs. Its liquidity positions are also fungible, meaning LPs receive ERC-20 tokens representing their liquidity. This makes managing positions easier and cheaper, as LPs don’t need to create a unique position for each adjustment.

Key Features of LBAMM:

- Zero Price Impact: Traders get the exact price they expect when executing trades within a bin.

- Lower Costs: Fungible ERC-20 tokens reduce gas costs and simplify position management.

- Flexible Positioning: LPs can decide how to distribute their liquidity across different price bins, customizing their strategy.

Things to Keep in Mind:

- Bin Selection: LPs still need to pick the right price bins, as liquidity can only be used within the selected bins.

- Not Ideal for High-Volatility Pairs: LBAMM works best for low-volatility assets.

Best For:

- LPs who prefer a passive approach and don’t want to actively manage their liquidity.

- Pairs with low volatility, such as stablecoins or tightly correlated tokens.

The Future of Pool Types on PancakeSwap Infinity

PancakeSwap Infinity’s architecture is designed to support future pool types. This flexibility allows developers to create custom AMM models, adapting to new trading strategies or token types. As DeFi continues to evolve, PancakeSwap Infinity ensures that LPs can access cutting-edge liquidity solutions.

Whether you’re an active trader looking for better capital efficiency with CLAMM or a more passive LP preferring the simplicity of LBAMM, PancakeSwap Infinity offers a pool type that suits your needs. With customizable liquidity ranges, flexible fee structures, and unique hooks, PancakeSwap Infinity sets the stage for the next generation of decentralized liquidity provision.

Visit PancakeSwap Infinity today to explore CLAMM, LBAMM, and more exciting opportunities in DeFi.